What's noteworthy about exchange rate margins is that they're seldom made transparent by traditional banks. They tend to hover around 5 or 6% of the total value of your transfer, with European currencies tending to be slightly cheaper in general than other foreign currencies. This all comes down to the fact that the exchange rates Bank of America offers you will be ever-so-slightly worse than the exchange rates it itself uses to exchange your currency (known as the mid-market exchange rate.)īank of America's exchange rate margins are relatively high - typically between 5 and 7% of the total transfer amount.Īs you can see above, exchange rate margins at Bank of America are fairly consistent. In essence, this means that the bank will make a small profit off of every single dollar that it exchanges into a foreign currency on your behalf. In addition to the standard set of fees outlined above, Bank of America will also charge what's known as an exchange rate margin every time you transfer abroad. They could be levied without warning by a third-party bank if Bank of America cannot make your transfer directly to your beneficiary's bank. These fees will typically cost you anywhere between $10 and $100 per transfer. What they're referring to here is what's known as a correspondent bank fee, a kind of "middleman" fee that can apply to transfers going over the SWIFT network. Over and above the exchange rate margins and transaction fees that you'll be paying when you make an international wire with Bank of America, there may still be other expenses before the money arrives in your beneficiary's bank account.Īccording to Bank of America's fee schedule, taxes "and other third-party fees" may apply to your international bank wire.

#Bank of america wire transfer how to#

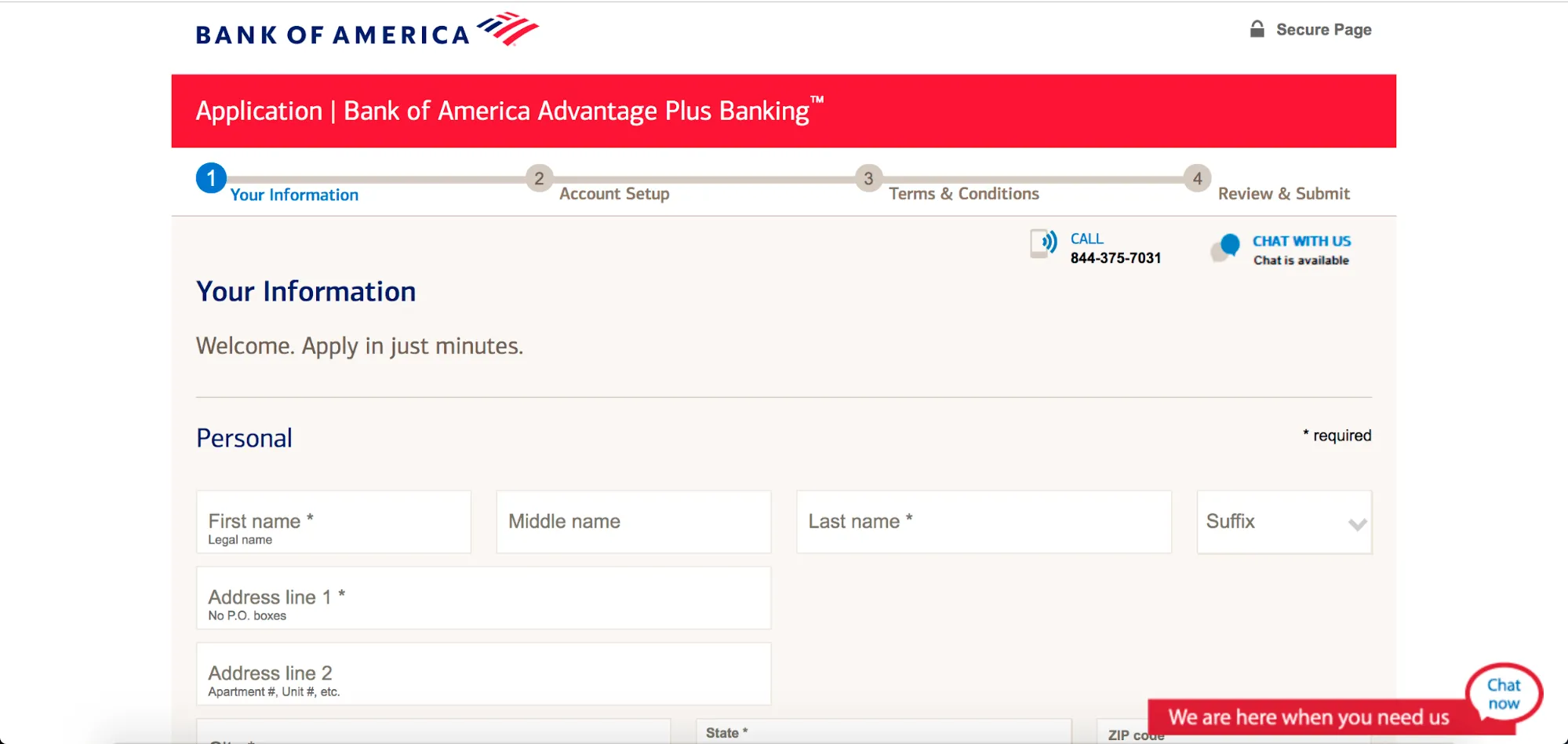

If you'd like to find out how to make a bank wire transfer, take a look at our step-by-step guide here. The maximum threshold is only $1,000! If you enrol with Bank of America's SafePass security scheme, then you'll be able to raise this limit significantly, however. not a business), you will face a very tight limit on how much money you can send abroad daily with Bank of America. Remember that, as an ordinary consumer (i.e. A total fee waiver for outbound international wires to a foreign currency bank account sent in the same foreign currency.A $45 transaction fee for outbound international wires to a foreign currency bank account sent in US dollars.These transfers, which are distinctly different from ACH payments, mean that Bank of America will wire your funds over the SWIFT network and charge a set of fixed fees for the service.

To send money abroad with Bank of America, you'll need to use a bank wire (also known as a "wire transfer") to get the job done.

What Are Bank of America's International Wire Transfer Fees?

0 kommentar(er)

0 kommentar(er)